Those who like to bash California have been tsk-tsk’ing at California’s budget problems, trying to blame California’s “public sector.” California’s budget shortfall, at present, is estimated to be about $22 billion.

For comparison, the bailout of one bank alone — Citicorp — means that American taxpayers have now given $60 billion in direct assistance to Citicorp, plus $340 billion in guarantees. That comes to $400 billion, to one private bank! So far, the United States government has made about $12.7 trillion in guarantees and other financial commitments to private interests — Wall Street.

Another bit of perspective: During the California “energy crisis” of 2000 to 2001, Enron and other private interests ripped off Californians for between $30 billion and $70 billion, depending upon where one gets the numbers. Enron, by the way, paid no federal income taxes in most years and even used gimmicks to get tax rebates.

The reason California has a budget problem is that its revenue has fallen off a cliff because of the economic catastrophe brought to us by Wall Street. Last month, sales tax revenue in California was down 51% compared with last year, and personal income taxes were down 44% compared with last year. Californians are not making much money, and they aren’t spending much money.

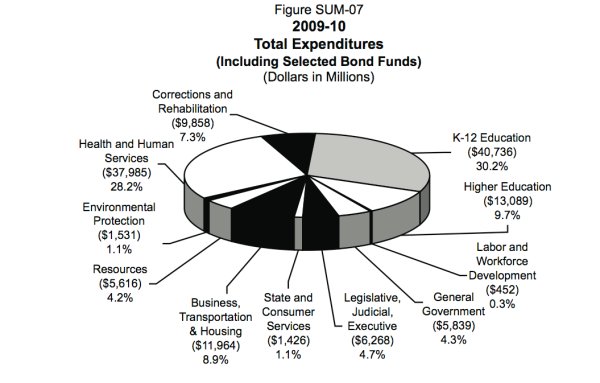

If you look at the pie chart for California’s revenue, it’s pretty obvious which sector of the economy is not paying its fair share. California could easily fix its budget problem by increasing corporate taxes.

All the noise about public spending and the public sector is propaganda, distortion, and distraction. It’s unregulated greed and a corrupt Congress that we need to focus on.

Post a Comment