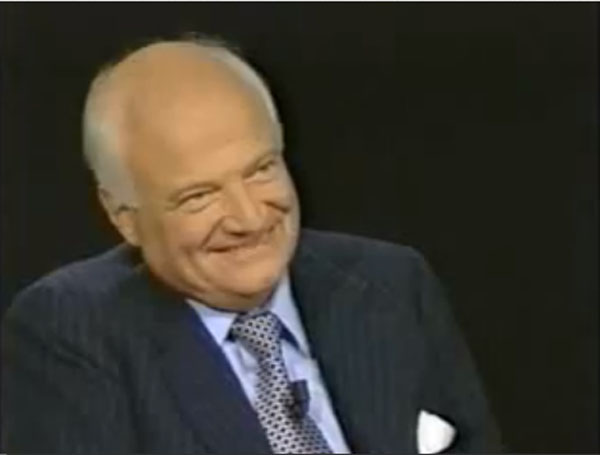

James Goldsmith on the Charlie Rose show, Nov. 15, 1994

The devastation to our economies caused by globalization and Wall Street gaming was predictable. It also was predicted. Those of us who, in the 1990s, failed to anticipate where globalization would lead now have an obligation to look back and try to understand why we got it wrong. The video I’m going to link to is a huge help in this process.

It is easy to see why so many people embrace ideology as a way of making sense of the world. The world is extremely complicated and hard to model, so ideology simplifies things and provides some comfort.

Those of us who disdain ideologies and try to understand the world as it actually is take on a huge work load. Not only must we absorb huge amounts of information, we must try to figure out who we can trust and who has disguised motives and seeks to hoodoo us.

In the 1990s, I subscribed to The Economist, which is considered to be ever so authoritative. I fell for The Economist’s predictions about globalization, which was that globalization would lead to increased prosperity for all. The Economist, like the governments of the United States and Europe, was catastrophically wrong. As I began to understand this, I dropped my subscription to The Economist, and I will never trust them again.

So who got it right? Very few people got it right. Among those few was James Goldsmith, a European tycoon and politician who prophesied all this with a book named The Trap. Goldsmith died in 1997.

On YouTube you can find the video of an hour-long interview with Goldsmith by Charlie Rose. Goldsmith predicts it all — the offshoring of jobs and devastating unemployment, the loss of our manufacturing base, the severe neglect of our infrastructure, the flight of hundreds of millions of people in China and other poor countries from farms to the cities, a crisis in agriculture, a massive transfer of wealth from working people to the rich. Goldsmith, we can see in retrospect, was able to make these predictions because he understood and modeled the real world, and he was not thrown off by an ideology. He had principles, though. And one of those principles, despite his great wealth, was that the welfare of the people is far more important than markets and their profits.

We also can learn a lot from this video about how the media and politicians lie to us and mislead us. Charlie Rose was almost combative with Goldsmith and kept interrupting Goldsmith to spout the establishment point of view. Rose also brought on Laura Tyson, then the chair of President Clinton’s Council of Economic Advisers. She also kept interrupting Goldsmith and shouting the establishment point of view.

At the time, I think that I too would have discounted Goldsmith’s ideas, largely because of his record as a tycoon. It is incredibly difficult to identify experts who we can trust. But one thing is very clear: We can’t trust the media, because they speak for the establishment. And if there is anyone in Washington who can be trusted, I’m not aware of it, because corporations own Washington.

This process of checking ourselves and understanding why we were wrong when we are wrong is extremely important. That is one of the major failures of our media and our punditry. They rarely admit their failures or revisit their mistakes. It is up to us to catch their errors when they are dangerously wrong and to simply never pay them any more attention. They have agendas, or they are blinded by an ideology.

Principles, of course, are a good thing, and Enlightenment principles have stood the test of time. But ideologies only guarantee that we will be wrong and that we will neglect or belittle the hard work of trying to understand the world as it is.

We got it wrong about globalization, and now we are paying the price for our wrongness. And those who pushed for globalization (while we were asleep at the switch) are richer and more powerful than ever. As a friend of mine who is a law professor said, “It’s over. We lost.”

Update: From DCS (the law professor), who also has commented on this post, is a link to the entire, unsegmented video, Google video, here. The YouTube link above is in six segments. The YouTube version will play on iPads; the Google video version requires Flash and will not play on iPads.