Above: Household debt-to-income ratio [Merrill Lynch]

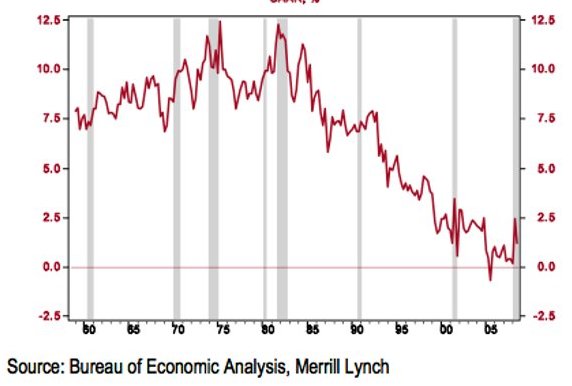

Above: Personal savings rate [Merrill Lynch]

I am strongly of the opinion that economic literacy is a personal survival skill, like knowing how to cook, or fix a leaky pipe. This recent article from Merrill Lynch does an excellent job of pulling together and charting some of the factors and trends that point to very hard times ahead. The report says that this is probably a Depression, not a mere recession, and it attempts to define the difference.

One of the most unpredictable areas, it seems to me, is the tension between deflation and inflation. Prices for many things are dropping as global demand drops and supply exceeds demand. But already the American Federal Reserve is buying treasury bonds, which means that we are printing dollars. Printing dollars can only lead to inflation. And yet, this is a global phenomenon, and it’s possible that the dollar will remain relatively strong compared with other currencies. Personally I fear that we’ll be whipsawed as deflation quickly reverses into inflation at some point. Some economists argue that there can be no severe inflation without a wage-price spiral, and wages aren’t going anywhere. No one knows. But we have to keep trying to look ahead.